Building on your own land with Comerio Homes is a rewarding experience that combines the advantages of a personalized home with the efficiency of our expert process. Our focus is on delivering exceptional homes and offering a streamlined process to make building on your land as straightforward and enjoyable as possible. Here are a few benefits of building on your land.

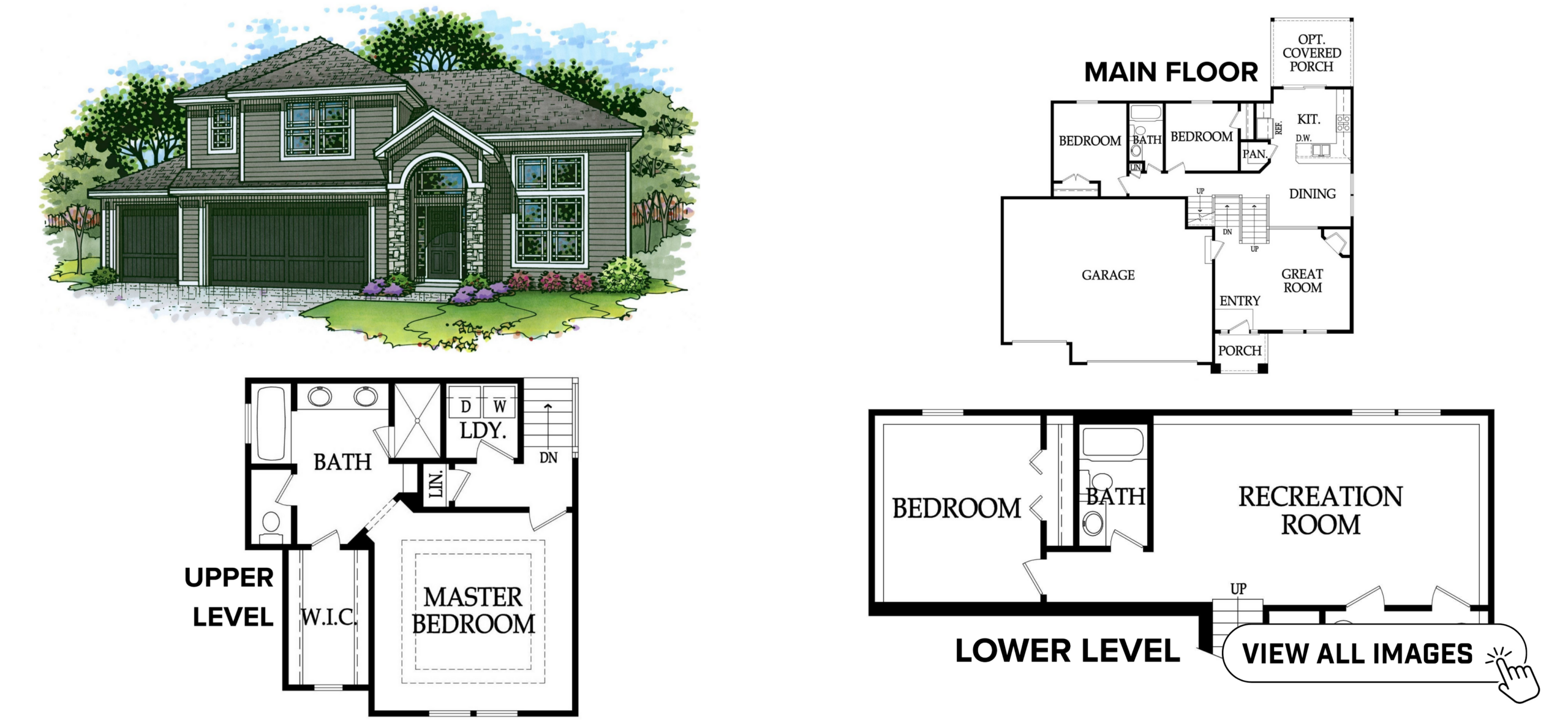

- Personalization: Building on your land allows you to create a home that reflects your unique style and preferences. With our pre-designed floor plans, you can choose the layout that best fits your vision and customize it with a range of options & upgrades.

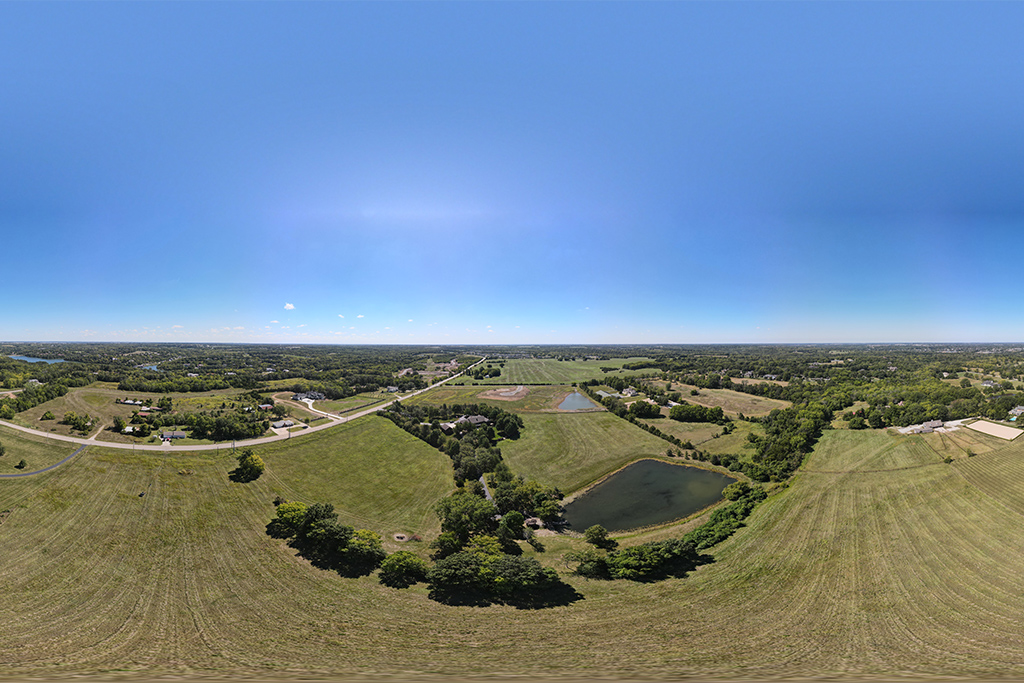

- Maximized Land Use: We help you make the most of your land’s natural features and advantages, ensuring that your new home complements the landscape and fits seamlessly into its surroundings.

- Streamlined Process: Our team manages the complexities of the building process, so you can focus on personalizing your home and enjoying the journey.

- Efficiency and Expertise: Leveraging our experience and relationships to provide a more efficient path to homeownership, minimizing the time and effort required compared to starting from scratch or going it alone.

Before purchasing land for your new home, there are several important factors to consider:

- Size of the Land: Determine if the land size meets your needs for your home, outdoor spaces, and any additional features you plan to include.

- Financial Blueprint: Scrutinize your budget meticulously. Ascertain the financial outlay you’re prepared to commit to the land and your home’s construction. Remember that land prices can oscillate dramatically based on geographical location and inherent attributes.

- Land Features and Challenges: Evaluate the natural features and potential challenges of the land, such as terrain, soil quality, and vegetation, which may impact construction.

- Access to Utilities: Check the availability and accessibility of essential utilities like sewer, electricity, water, and gas.

- Proximity to Neighbors: Consider the distance between your land and neighboring properties for privacy and community considerations.

- City or County Requirements: Understand local regulations and requirements that may affect your building plans.

- Zoning: Verify the zoning classification of the land to ensure it is suitable for residential construction and any additional uses you envision.

- Easements: Identify any easements on the property that may affect your ability to build or use the land as intended.

- Flood Plains: Check if the land is located in a flood plain, which could impact construction and insurance requirements.

When building your new home on your land, consider incorporating these popular features to enhance your property:

- Machine Shed: Ideal for storing equipment and tools.

- Stables / Riding Arena: Perfect for equestrian enthusiasts and horse care.

- Swimming Pool: A great addition for relaxation and recreation.

- Carriage or Guest Home: Provides extra space for guests or additional family members.

- Horses or Livestock: Accommodate your animals with appropriate facilities.

- Pond: Adds beauty and tranquility to your landscape.

- Gated Entrance: Enhances security and privacy for your property.

These considerations and features can help you maximize the potential of your land and create a home that suits your needs and lifestyle perfectly.

Building on your own land involves navigating a complex landscape of licenses and permits, each tailored to ensure your project complies with local regulations. This process includes securing local building permits, obtaining zoning approvals, and addressing environmental and site-specific permits. At Comerio Homes, we streamline this process for you, handling the intricacies of permit applications and regulatory compliance. Our expertise ensures that your construction journey is smooth and compliant, allowing you to focus on turning your vision into reality. Partnering with us means avoiding costly delays and achieving your dream home with confidence.

Planning your budget for building a custom home is a critical step that sets the foundation for your project. Here’s a streamlined approach to help you estimate your budget effectively:

- Assess Your Finances: Start by evaluating your financial health, including savings, income, and potential loans or mortgages. Knowing your financial standing will guide you in setting a realistic budget.

- Set Your Priorities: Identify what aspects of your home are essential and where you can be flexible. Decide on the size, design, and special features of your home to allocate your budget where it matters most.

- Include a Contingency Fund: Set aside about 10% of your budget for unforeseen expenses. This buffer helps manage unexpected costs that may arise during construction.

- Plan for Long-Term Expenses: Beyond construction, consider ongoing costs such as property taxes, utilities, and maintenance to ensure your budget remains sustainable.

Step 1 – SELECT YOUR LAND

Step 2 – REVIEW FEATURES OF THE LAND

- Discuss specific features of the land (size, site prep needed, positioning of home)

- Discuss length of driveway / available utilities / sewer or septic system

Step 3 – PICK A FLOOR PLAN

- Select a floor plan from Comerio Homes website

Step 4 – CUSTOMIZE YOUR HOME

- Review buyer specific options & upgrade to include in your new home

Step 5 – DISCUSS FINANCING

- Construction to perm loan is required to build on buyer’s land (refer to preferred lender list)

(This is due to buyers having title to the land in their name)

Step 6 – PROJECT FEASIBILITY

- Execute project feasibility agreement

- Non-refundable fee is due to retain Comerio Homes due diligence services

- Buyers must own the land or have the land under contract before any due diligence can be performed.

Step 7 – DUE DILIGENCE

After the feasibility agreement is signed Comerio Homes will review the following Items:

- City / jurisdiction (restrictions, permitting, codes)

- Review zoning

- Review the size of the property

- Review setback restrictions & easements (when information is provided by a title search)

- Review HOA requirements (if applicable)

- Review the desired positioning of home on land (if possible)

- Site visit to land by Comerio Homes rep (if land is walkable or accessible)

- Provide estimate or allowance for plot plan survey (survey not included)

- Provide estimate or allowance for percolation test (required for septic system quote, test not included)

- Provide estimate or allowance for septic system install

- Provide estimate or allowance for site prep (clearing trees, brush, culvert install, etc.)

- Provide estimate or allowance for driveway length & utility connections

Step 8 – REVIEW PRICING

– PRICING

- Comerio Homes will produce a pricing summary estimate outlining the costs and allowances to build your home (only if buyer selected a Comerio Homes floor plan, if buyer provided a floor plan additional estimating will apply)

Step 9 – SIGN NEW HOME SALE CONTRACT

- CONTRACT PREPARATION (Contracts will be provided prior to meeting for review)

DO I NEED TO OWN THE LAND?

Ultimately yes, you need to own the land to start construction, however you do not need to own the land if doing your due diligence or to meet with Comerio Homes. You should, however, at least have the land under contract to purchase.

DOES COMERIO HOMES SELL LAND?

Comerio Homes does not have larger tracts of land for buyers to build on. If you are searching for land to build on you will need to consult with a real estate agent to search for that perfect property. If you need a real estate agent who specializes in land, please let us know and we can connect you.

CAN I FINANCE MY LAND INTO MY CONSTRUCTION LOAN?

Yes, timing is everything so make sure to give yourself enough time to close on the land at the same time as the construction loan. To do this you will need to have everything ready to go as far as a permit-ready floor plan and contract ready pricing.

CAN I COUNT LAND EQUITY TOWARDS MY MORTGAGE DOWN PAYMENT?

Yes, most landowners have equity in their land and lenders use that as part or all of your required down payment for your mortgage.

WHAT IS A CONSTRUCTION TO PERM LOAN AND WHY DO I NEED IT?

Typical new home construction is financed by the builder getting a construction loan to build the home. When the home is complete the buyer gets their mortgage loan to buy the home from the builder. That is two loans with two sets of loan and appraisal fees.

A construction to perm loan is one loan that the buyer gets up front for construction and when the home is complete that same loan turns into your normal 30-year mortgage. This type of loan is required when building on your land because you have the title to the land making it not possible for a builder to get a lender to loan money for construction on land that you own.

Once construction has started the buyer does not have to do anything more as all construction draws are processed between the builder and the lender. Please see our Financing page for a list of our preferred lenders who do construction to perm loans.

WILL I BE REQUIRED TO MAKE MONTHLY PAYMENTS DURING CONSTRUCTION?

No, the cost to construct your home should be included in your construction loan and monthly interest payments will be a part of that loan. The lender will process monthly draws with Comerio Homes which will include monthly loan payments.

DO I NEED TO PURCHASE FLOOR PLANS?

No, you do not have to purchase floor plans. You can select one of Comerio Homes’ floor plans and customize it to fit your needs.

CAN I BRING MY OWN FLOOR PLANS?

Yes, you can bring your own floor plans, however, there may be more work required to get those plans ready for pricing and permitting. Most floor plans purchased online, for example, do not have engineering provided on the plans which are needed to provide accurate pricing, and for permitting. Bring us what you have, and we can go from there.

DOES COMERIO HOMES PROVIDE DUE DILIGENCE SERVICES TO REVIEW YOUR LAND?

Yes, we provide all the due diligence you need to review all the things needed to build the home of your dreams. We start the process by executing our project feasibility agreement with a deposit.

HOW MUCH DEPOSIT IS REQUIRED TO START DUE DILIGENCE OF YOUR LAND?

A minimum deposit of $5,000 is required to start the due diligence process.